A salaried individual will have less tax stress

With a lot more to invest, a senior’s retirement plan will progress

With Mahila Samaan Savings Certificate as new astra, no Men will ever Mess

A homepreneur or a professional will be happy to pay less tax.

Budget 2023 has changed the way we do our tax planning and investments

Our Income Tax Rates

As per the existing IT rules, a taxpayer has the option to choose an old tax regime, in which one can make investments or claim certain expenses, thereby reduce the taxable income. One has to choose from prescribed list of deductions to lower the income.

This is the default regime so far and the tax rates are as follows-

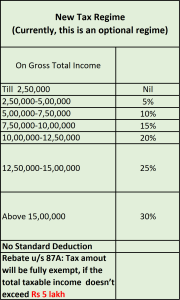

Since 2020, we have the option to pay taxes as per a new regime in which no deductions (series of deductions like Section 80C, 80D or Section 24b for housing loan interest) can be claimed. The taxable income so arrived is then taxed as per new income tax slab rates.

Come April 2023, your default tax regime will be the new tax regime with the following tax rates.

Old vs New Regime: What is best for you?

While the Budget has allowed a standard deduction of Rs 50,000 and a rebate on the income of Rs 7 lakh (as against Rs 5 lakh in the old regime), the answer depends on the amount of investment you are doing simply to save taxes.

With the help of your chartered accountant or online tax assistant, draw out the list of deductions that you claim as of now. These calculations will help you arrive at the tax liability and the regime to opt for.

#GruhiniGyaan: New Saving Style in a New Tax Regime

If the new tax regime proves to be beneficial for your taxes, it may be wise to re-think some of the investment choices we typically make for sake of tax deductions only. Like-

- Do I need to buy another home to claim a deduction of principal and interest?

- Can I say NO to the agent uncle who comes through family recommendations and sells me insurance policies to claim taxes?

The money you were to spend for investing in tax-saving instruments, you can now deploy it for other purposes or goals.

Taxation on your Insurance Money

From April 1 2023 onwards, if you pay an aggregate annual premium of more than Rs 5 lakh towards certain insurance policies (other than unit-linked plans), then the money received on maturity from such policies will be taxable as per the income slab of the individual.

Insurance makes good a loss we can’t forsee. In simple-term life plans, you pay premium and get money only on death.

OR

Policies that have a portion of the premium towards insurance and the rest is invested in various investment plans as per your choice. Such policies pay the Sum assured on death or the remaining market value of invested amount on maturity (Unit-linked insurance plan)

OR

Policies that have saving and insurance elements and give lumpsum amounts on maturity.

How’s insurance taxed?

- Insurance Money received on death is tax-free in all types of policies.

- Insurance money received on maturity (when the policy term ends), it’s exempt ONLY if

-insurance premium doesn’t exceed 10% of the sum assured

-For Unit-linked plans-premium amount doesn’t exceed Rs 2.5 lakh a year

– For all other non-linked plans, only if the aggregate premium doesn’t exceed Rs 5 lakh in a financial year, then maturity proceeds will be tax-free.

From April 2023 onwards, high premium policies with an aggregate premium of more than Rs 5 lakh (in a year) will be taxed when money is received on maturity.

With a lot more to invest, a senior’s retirement plan will progress

Senior Citizens feel extremely comfortable with safe or guaranteed return instruments hence, the investment limit in two important schemes has been increased significantly-:

With Mahila Samaan Savings Certificate as new astra, no Men will ever Mess

Mahila Samman Saving Certificate (MSSC) is a new deposit scheme in which a deposit of up to Rs 2 lakh can be made in name of a woman or a girl child. A fixed interest rate of 7.5% will be paid for a two-year period and contributions will not have any tax benefits. Partial withdrawal may be allowed in the scheme. No age limit has been disclosed yet.

#GruhiniGyaan- While 7.5% interest looks promising for now, the scheme returns may look unattractive if other deposit avenues increase interest rates in near future.

A homepreneur or a professional will be happy to pay less tax.

If as a resident individual, you run a business (which is taxed as per a Section 44AD) whose turnover is not more than Rs 2 crore, your income is presumed to be 6% or 8% of your turnover and you pay tax on such presumed income.

The budget has increased this limit to Rs 3 crore.

If you are a professional like an accountant, architect, movie artist, legal person (as eligible under Section 44ADA) and your income doesn’t exceed Rs 50 lakh, you pay tax only on 50% of your total income.

The budget has increased this limit to Rs 75 lakh.

This article is purely for educational purposes. Please consult your tax advisor before taking any financial decisions. We can assist you in finding the right tax advisor for your tax planning. For further info, do write to us at rachna@thegreatgruhini.com